iron ore price continue to rally high

Iron ore prices continued to rally on Monday as Chinese imports top one billion tonnes, port stocks fall and the country’s steelmakers – responsible for more than half the world’s crude output – ramp up production.![]()

![]()

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China (CFR Qingdao) were changing hands for $146.93 a tonne on Friday, up 1.3% from Friday’s peg.

That was the highest level for the steelmaking raw material since March 2013 and brings gains for 2020 to just shy of 60%.

CAPITAL ECONOMICS EXPECTS IRON ORE PRICES TO FALL BACK NEXT YEAR IN PART BECAUSE A RECOVERY IN BRAZILIAN PRODUCTION SHOULD SWING THE MARKET INTO A SURPLUS

Prices for 65% fines imported from Brazil now stand at $159.10 per tonne on Monday, with both grades up more than 20% just over the last month.

Cargo go-go

Customs data released over the weekend showed a month-on-month decline for iron ore imports into China in November, but an 8.3% jump compared to the same month last year.

“Shipments from Australia and Brazil were at relatively low levels in the last two months,” Richard Lu, senior analyst with CRU in Beijing told Reuters, adding that December shipments are normally higher.

For the first 11 months of the year, China imported 1.07 billion tonnes, already surpassing 2019’s full year shipments total and on course for a new annual record above 2017’s 1.075 billion tonnes.

Port stocks deplete

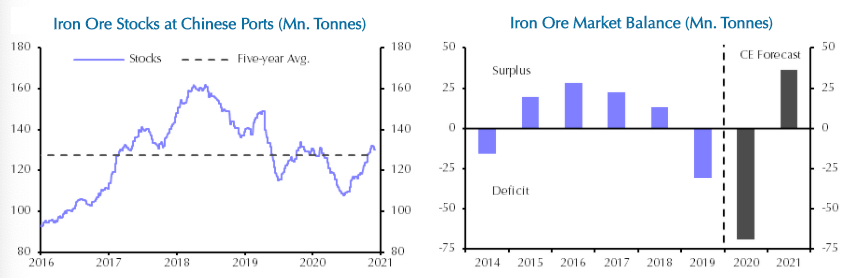

In a note, Capital Economics points out that despite elevated levels of imports, stocks at Chinese ports have declined towards their five-year average of around 130 million tonnes.

Capital Economics expects iron ore prices to fall back next year in part because a recovery in Brazilian production should swing the market into a surplus:

Meanwhile, we suspect that China steel production will remain high this winter, instead of falling sharply like last year, as many steel mills have upgraded their facilities to comply with anti-pollution requirements. As a result, we forecast that the price of Chinese steel will ease back in 2021.

THE STEEL BODY ALSO SAID RECENT ORE PRICES HAD DEVIATED FROM SUPPLY AND DEMAND FUNDAMENTALS

Risks for steelmakers

Reuters reports the China Iron and Steel Association said on Sunday the sharp rise in the iron ore price has increased operational risks in the industry.

The steel body also said recent ore prices had deviated from supply and demand fundamentals and noted some abnormal bidding by traders had fuelled index growth, according to an interview with the CISA vice chairman by the official Xinhua News.

![]()